May 15, 2025

Over the last few years, I’ve found myself thinking more seriously about my health. Not just about living longer, but about living better.

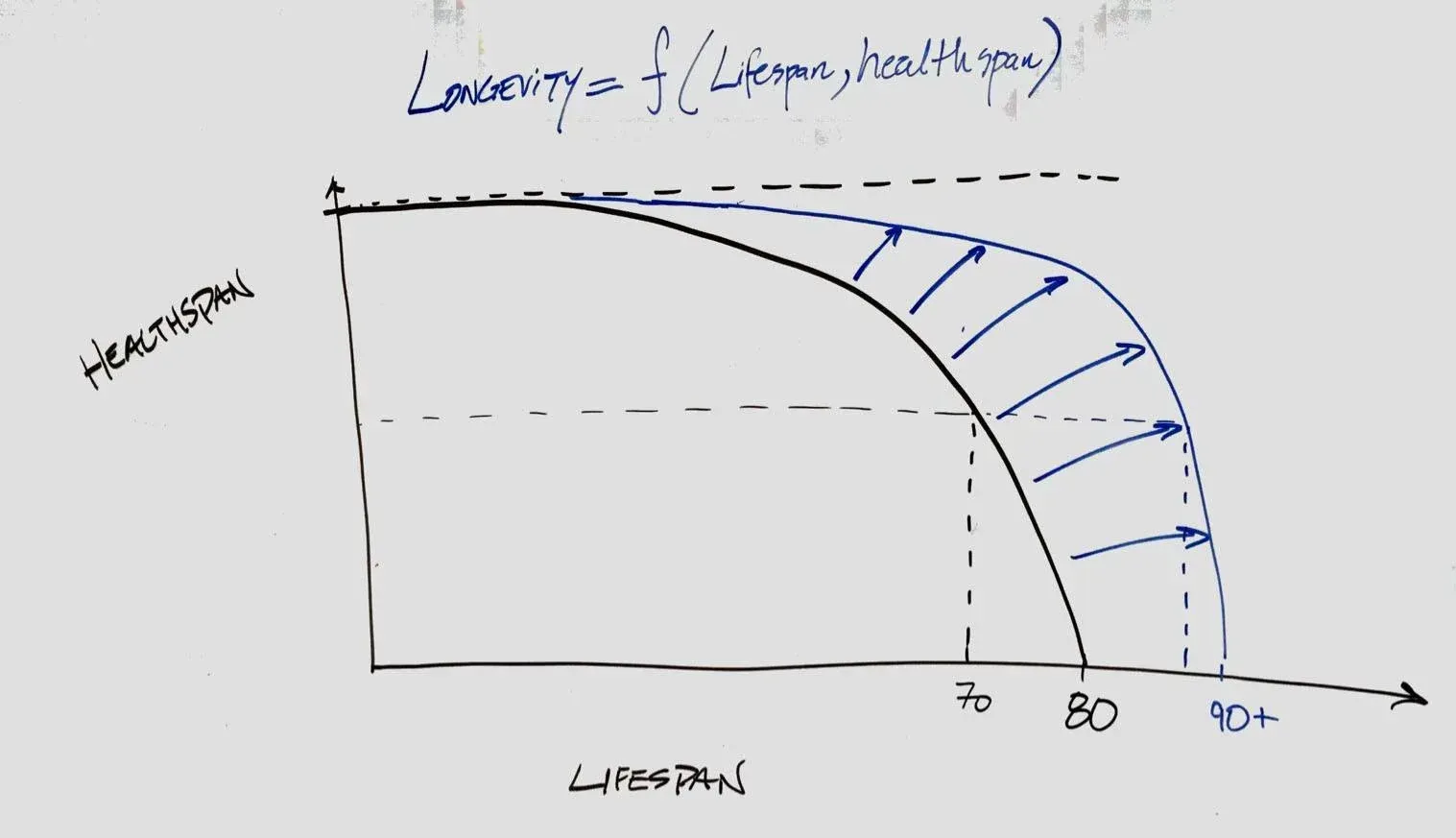

Like many people in their 40s, I’ve started paying closer attention to strength, energy, and stamina - how I want to show up in the years ahead. That interest led me to the work of Dr. Peter Attia, one of the leading voices in longevity and performance medicine. His work around healthspan versus lifespan really struck a chord with me.

Healthspan refers to how long you live in a strong, capable, and fully engaged state.

Lifespan is simply how long you live.

Dr. Attia’s goal is to help people compress the period of decline so that we remain functional and high-performing until the end of our lives. He wants to bring healthspan and lifespan into alignment so we can avoid a long, slow (and potentially painful) decline.

It’s a powerful concept that stuck with me.

And then — in a nice bit of irony — I ended up at the pub having beers with my friend Bradley Clark, talking about how modern recruitment needs to evolve. Not exactly a longevity hack, but sometimes good ideas come with a pint in hand.

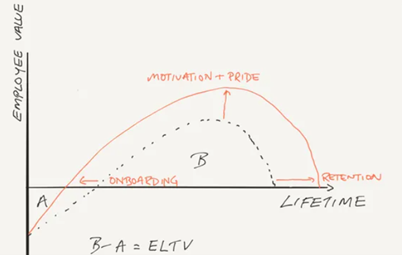

Bradley introduced me to a term I hadn’t heard before: ELTV, or Employee Lifetime Value. We got talking about how hiring isn’t just about putting people in seats, it’s about long-term value and sustained contribution. As soon as he explained ELTV, it immediately clicked. It was the bridge between the health and performance thinking I’d been exploring personally, and the way I’ve always viewed hiring professionally.

If it weren’t for that conversation, this article probably wouldn’t exist.

What This Has to Do With Hiring

Too many companies hire with a short-term mindset. Someone joins with great energy and potential. They take time to ramp up and learn the systems. Eventually, they start delivering real value. But if that performance isn’t sustained — if there’s no clear path forward, no support, or no feedback — they can begin to drift.

They may remain employed. They may still appear to be doing the job. But the spark is gone. Their output slows. Their engagement fades. They become a steady presence, but not a powerful contributor.

This is where the difference betweenemployment span and productivity span becomes clear. Just like healthspan and lifespan, the two can easily become misaligned.

The ELTV Framework

Employee Lifetime Value (ELTV) is a way to measure the total value an employee contributes over the duration of their time with your organization. It shifts the conversation from “How long did they stay?” to “How much did they truly contribute?”

Let’s define two simple terms:

Employment span refers to the total time someone remains with your company.

Productivity span refers to the window of time when they are engaged, growing, and delivering measurable business outcomes.

In an ideal world, those two timelines would be nearly identical. Someone would start strong, continue to grow, and sustain their impact through to the end. But in practice, there’s often a lag at the beginning and a fade at the end. That gap is where business performance erodes — quietly and consistently.

Why the Gap Is So Costly

When someone isn’t delivering, the costs pile up in ways that are easy to miss. Projects slow down. Other team members pick up the slack. Managers spend more time coaching, reviewing, and redoing work. Payroll continues to be paid, but the return on that investment falls.

It’s not just about productivity either. When engagement fades, it affects culture. Teams notice. Morale dips. Standards shift.

That’s why ELTV is such a useful concept. It encourages leaders to pay attention not just to how long someone is employed, but to how much value they are actually delivering during that time.

Hiring That Moves the Needle

If we want to build teams that perform consistently, we need to think differently about hiring.

It starts with outcome clarity. What does success look like in the role? What business results will this person be expected to drive? How will you measure whether they are thriving or just maintaining?

It also depends on how you hire.

At Horizon, we’ve designed our recruitment process around what we call theE3 Standard:

- Effective hiring aligns with business outcomes and is built around clearly defined performance expectations.

- Enjoyable hiring provides clarity, transparency, and a professional experience for both the client and the candidate.

- Empowering hiring ensures that the person coming into the role is set up to succeed, not just survive, with the right tools, onboarding, and leadership support.

E3 isn’t a slogan. It’s a standard.

It’s how we evaluate the quality of the hire, the value of the process, and ultimately, the impact on the business.

Recruiters Who Think Like Partners

Too many recruiters are still playing a transactional game. They fill the role, send the invoice, and move on.

That’s not ideal.

Instead start with the business. What needs to be accomplished? What is the actual problem that needs solving? What outcomes does this role support?

Once we understand that, design a search that targets people who will deliver results — not just meet requirements. The best approach helps define success, sets clear expectations, and runs a process that attracts the kind of professionals who want to be part of a high-performance environment.

Thinking Like a Performance Strategist

When you view hiring through the lens of longevity and contribution over time, everything changes.

You start asking better questions. You stop focusing only on resume fit and start thinking about potential, adaptability, and value over time.

You begin to track things like:

- Time to productivity

- Duration of peak performance

- Early indicators of disengagement

This approach doesn’t just improve hiring. It improves leadership, retention, and team performance across the board.

Closing Thought: E3 as a New Standard for Hiring

Dr. Attia’s mission is to help people avoid a slow, drawn-out decline. His vision is for people to live fully, right to the end. We believe recruitment should work the same way.

You don’t want employees who stick around for the sake of tenure. You want people who continue contributing, growing, and making an impact — every step of the way.

That’s what ourE3 approach is designed to deliver:

- Effective hiring that aligns with business performance.

- Enjoyable hiring that builds trust and clarity.

- Empowering hiring that gives people the opportunity and support to thrive.

If that’s the kind of hiring you want to do, let’s talk.

Because recruitment done right is not just about filling a role.

It’s about building something that lasts.

Share Blog

Latest Blogs